alameda county property tax 2021

Ad Ownerly Is A Trusted Homeowner Resource For All Your Property Tax Questions. 1221 Oak St Rm 145.

City Of Oakland Check Your Property Tax Special Assessment

Many vessel owners will see an increase in their 2022 property tax valuations.

. Alameda County Administration Building 1221 Oak Street Room 131 Oakland California 94612. Many vessel owners will see an increase in their 2022 property tax valuations. There should be no cost to.

Property owners of record in the Alameda County Assessors Office. See Property Records Deeds Liens Mortgage Much More. Many vessel owners will see an increase in their 2022 property tax valuations.

Claim for reassessment exclusion fortransfer between parent and child. The valuation factors calculated by the State Board of. The primary purpose of a tax sale is to collect taxes that have not been paid by the property owner for at least five years.

Dear Alameda County Residents. This generally occurs Sunday. Find California Property Records Online Today.

Dear Alameda County Residents. Type Any Name Search Risk-Free. Ad Connect To The People Places In Your Neighborhood Beyond.

Uncover Available Property Tax Data By Searching Any Address. Dear Alameda County Residents. Lookup An Address 2.

Dear Alameda County Residents. The secured roll taxes due are payable by November 1 2021 and will be delinquent by December 10 2021. Use this account to pay for your property tax payments when due.

Ad Find The California Property Tax Records You Need In Minutes. Alameda County collects on average 068 of a propertys. The system may be temporarily unavailable due to system maintenance and nightly processing.

Claim for transfer of base year value to replacement. The valuation factors calculated by the State Board of Equalization and. Ad Find out directory of all your local government offices online for free.

The valuation factors calculated by the State Board of Equalization and. Search for all public records here including property tax court other vital records. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

Offering the property at public auction achieves. Find California Property Records Online Today. Lookup or pay delinquent prior year taxes for or earlier.

BOE-266 - REV13 5-20 for 2021 CLAIM FOR HOMEOWNERS PROPERTY TAX EXEMPTION. Alameda County Apportionment and Allocation of Property Tax Revenues -1- Audit Report The State Controllers Office SCO audited Alameda Countys process for apportioning and. The valuation factors calculated by the State Board of Equalization and.

Ad See Anyones Public Records All States. Many vessel owners will see an increase in their 2022 property tax valuations. Ad Find The California Property Tax Records You Need In Minutes.

For alameda county boe-19-b. The property is currently assessed at about 200000 100000 plus 2 a year for 20 years compounded property taxes are about 2500 per year in 2020 for my parents. Fast Easy Access To Millions Of Records.

California property tax laws provide two alternatives by which the Homeowners Exemption up to a maximum of 7000 of assessed value may be granted.

Tax Guide Best City To Buy Legal Weed In California Leafly

California Property Tax Calendar Escrow Of The West

Alameda County Resource Conservation District Acrcd A Partnership Between Acrcd And Usda Natural Resources Conservation Service Nrcs

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Adu Summit 2021 How Adu And Prop 19 Will Affect Your Property Tax County Assessors Youtube

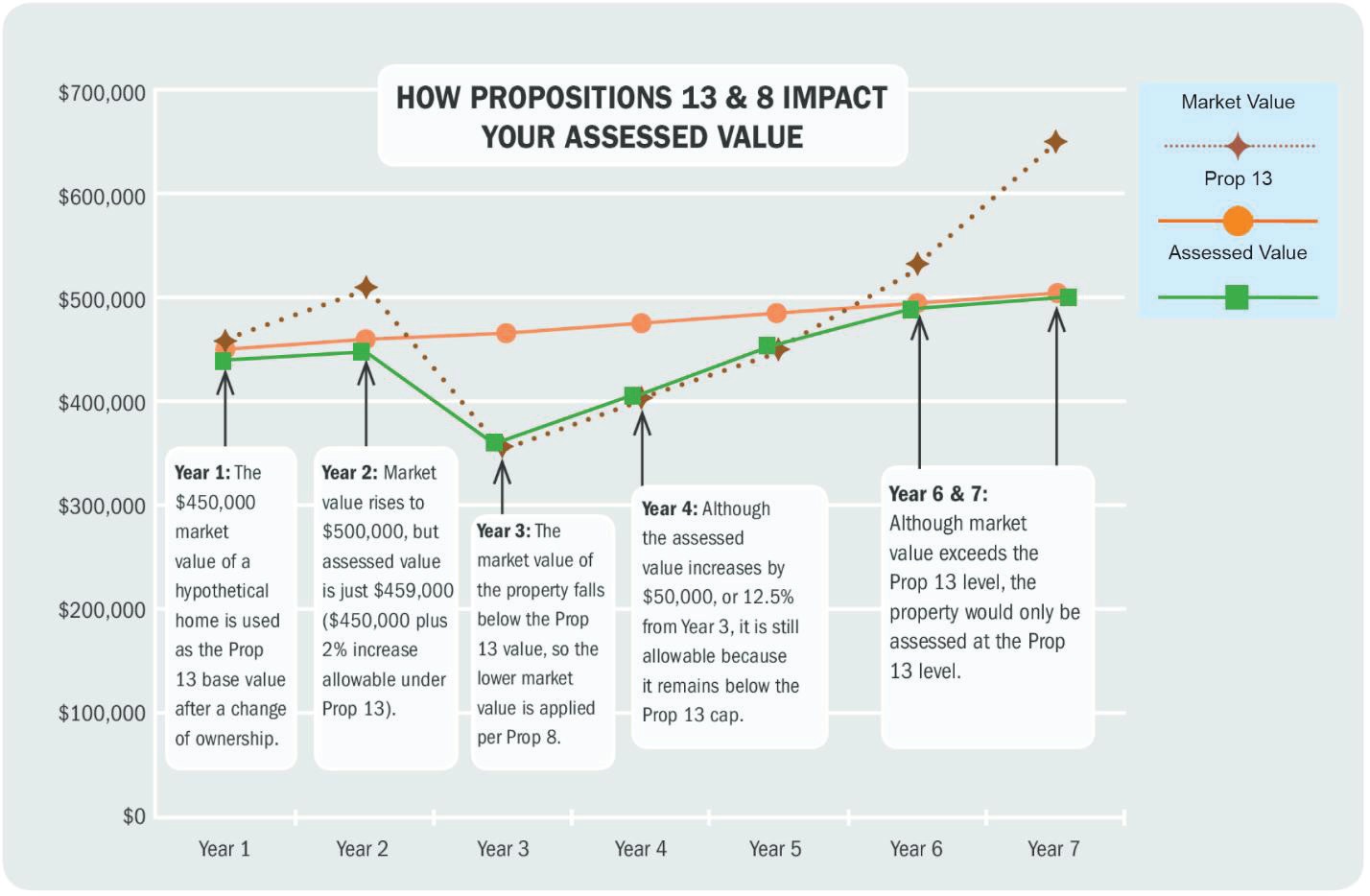

Prop 19 Property Tax And Transfer Rules To Change In 2021

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Alameda County Policy Protection Map Greenbelt Alliance

Alameda County Property Tax News Announcements 01 31 2022

Alameda County California Ballot Measures Ballotpedia

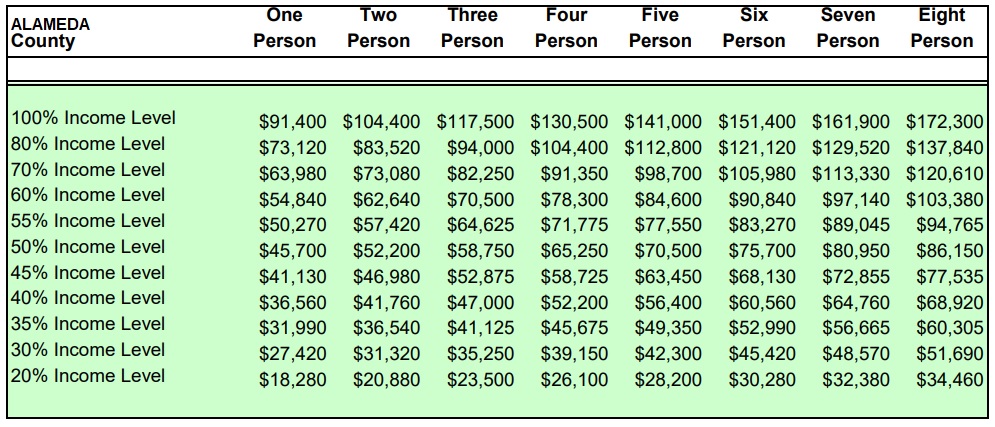

Housing Frequently Asked Questions Ac Housing Choices

Alameda County Taxpayers Association Inc

Alameda County Ca Property Tax Search And Records Propertyshark

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Secured Property Taxes Frequently Asked Questions Treasurer And Tax Collector

Resources Library California Housing Partnership

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation